CompHealth benefits for advanced practice locums and travel healthcare providers

January 12, 2026

Locum tenens work comes with great perks, like flexible scheduling and extra earning potential. While these assignments aren’t permanent roles, you won’t miss out on benefits. Unlike locum tenens physicians, who are considered independent contractors, advanced practice providers and other allied healthcare providers receive a W-2 and are offered a generous CompHealth benefits package.

What you get when you work with us

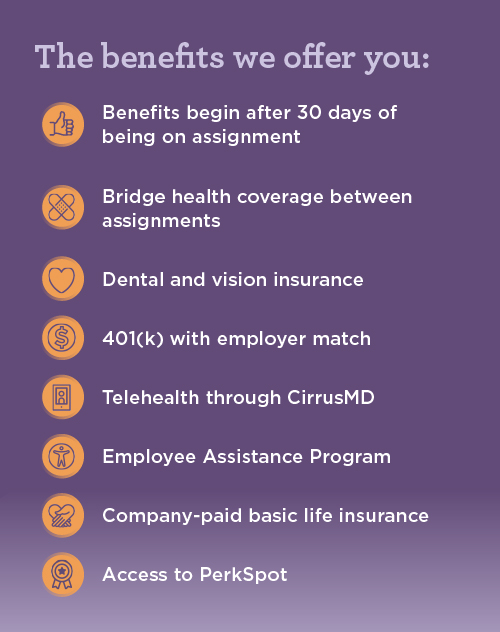

When you begin working with CompHealth, you will receive benefits after 30 days of working with us. Once you begin your assignment, you have a 31-day enrollment window to sign up for your benefits.

Medical, dental, and vision insurance

As a locum or traveler with CompHealth, you have three Regence BlueCross BlueShield medical plans to choose from, each with different deductible limits and premium costs. The plans are all PPOs, allowing visits to an in-network physician or healthcare provider of your choice without requiring a referral from your primary care physician. CompHealth pays a majority of the premium, while you pay only the employee contribution.

We also offer dental, prescription, and vision insurance.

Our third-party administrator is AmeriBen, and if you’re unable to reach a CompHealth benefits specialist, they’re available 24/7. You’ll also be given access to the MyAmeriBen app, which will simplify the process even more.

Why choose CompHealth? Hear why from NPs, PAs, and allied providers

401(k) with employer match

You'll also receive access to a 401(k) plan through Fidelity Investments. CompHealth matches 50% of the first 8% you contribute to the plan. While CompHealth only contributes to your 401(k) while you’re actively working, as long as you don’t have more than a 12-month gap between assignments, you’ll get credit for the money that’s already vested, and you’ll be fully vested within five years.

Telehealth, life insurance, and PerkSpot discounts

Other benefits include telehealth through CirrusMD. When you enroll in a medical plan, you are eligible to use the CirrusMD program. There is no cost to you or your dependents for this service if you are enrolled in either the Choice Care or Select Care plans. This service allows you to consult with a physician in order to obtain approved prescriptions over the phone.

Additionally, CompHealth provides an Employee Assistance Program, which offers free confidential assistance for financial, legal, and behavioral health issues. Each employee and their dependents are eligible for six free counseling sessions per calendar year.

You will also receive company-paid basic life insurance of $50,000 and have the option of purchasing pet insurance.

CompHealth offers our advanced practice providers and allied travelers access to PerkSpot, which gives you access to discounts and rewards for many different things, like airfare, ride share, cell phone products and services, and clothing and entertainment.

Hear from a nurse practitioner: How I choose which locum tenens agencies to work with

Coverage for you, your partner, and your dependents

CompHealth benefits for advanced practice and allied travelers are available to you, your spouse or same- or different-sex domestic partner, and your dependents.

Dependent children are covered up to the age of 26, or over 26 if they are disabled and unable to sustain employment.

How to sign up for benefits

Prior to your assignment start date, we will send you an email with a link to the enrollment portal where you select your benefits and complete your elections. Once you enroll, we will approve the benefits chosen, and the benefits’ effective date is retroactive to your assignment start date. It’s best to complete this process as soon as possible because your premium payments won’t be collected until they’re approved, which could mean a bigger payment once enrollment is complete.

Making changes to your benefits

You can make changes to your benefits any time you start a new assignment. It works just like an open enrollment period. Otherwise, changes can’t be made unless there’s what the IRS defines as a qualifying event, like marriage, childbirth, adoption, or divorce.

Stay on your game: Continuing education resources for healthcare providers

Benefits coverage between assignments

CompHealth offers a 31-day bridge period so you can remain covered while taking short breaks between assignments. If there are 31 days or fewer between your CompHealth assignments, your benefits remain intact with no need to re-enroll.

If the gap is longer than 31 days, the benefits are terminated, and you will need to re-enroll when you return to work with CompHealth. If you’re planning for a long break between CompHealth assignments and you still need your insurance coverage, let CompHealth know. You can sign up for COBRA coverage, which is effective the day following your contract end date. COBRA may be maintained for up to 18 months. However, it’s important to keep in mind that under COBRA, you will bear the entire cost of the premiums, which can be pricey.

How to get help with your CompHealth benefits

If you have questions about your benefits or need assistance, speak with your recruiter or contact the CompHealth people services team directly at 800.811.1796.

Are you interested in learning more about working locum tenens or travel assignments? Give us a call or view today's locum tenens job opportunities.